Content

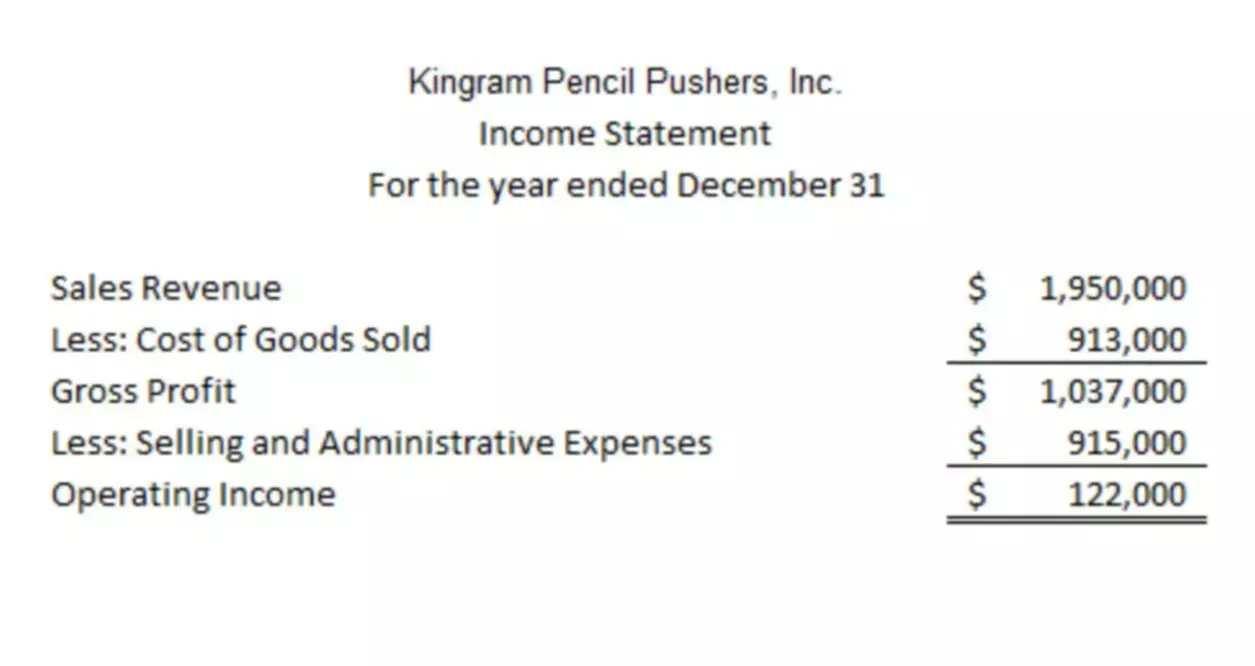

If you do not have a plan for taking action, there is a chance it will lead to irreversible cash flow problems. Prepare a profit and loss statement from the data you’ve collected. Outline how much your company made and spent in a given time period. This will be the first indicator of what your budget numbers should look like.

While you’ll eventually need to create annual and quarterly budgets, just start small for now. Try setting up a monthly budget and making that a keystone habit (aka a habit that helps kick-start other habits). This is the easiest way to stay out of the weeds https://www.bookstime.com/articles/how-to-create-a-business-budget but still crush your goal of controlling your finances. Tracking your expenses is a critical part of creating an effective budget. It’s important to have an accurate record of all income and expenditure as it can allow you to make better financial decisions.

The Small Business Community is now Small Business Resources.

The less you need for your business startup, the sooner you can start making a profit. Or, if you run a brick-and-mortar retail business, you may only have one source of income from your store sales. When you build a business, there are a lot of things to stay on top of, from marketing and finding new clients to building a website and establishing your digital presence. Budgeting isn’t a one-and-done activity you do four times throughout the year.

Try Shopify for free, and explore all the tools and services you need to start, run, and grow your business. Sign up for our newsletter — it’s packed with need-to-know info for business owners at any stage. You should also evaluate the return on investment (ROI) for these budget decisions by comparing the financial benefits your investments yield against the costs of those investments. Consider where you want to expand or what new initiatives you plan to undertake. This could be anything from launching a new product line to opening another store location or investing in cutting-edge technology.

Small Business Income Statement Template

Regardless of how you manage your money away from work, a business budget is essential because it increases financial responsibility. Businesses run on money, so you’d think that managing every dollar would be natural for business owners. Unfortunately, though, new business owners often overlook the crucial step of making a business budget before they launch. If times are tight and money must be found somewhere in order to pay a crucial bill, advertise, or otherwise capitalize on an opportunity, consider cost-cutting. Specifically, take a look at items that can be controlled to a large degree. Another tip is to wait to make purchases until the start of a new billing cycle or to take full advantage of payment terms offered by suppliers and any creditors.

- One way to do this is to lay out the process in a series of steps.

- Capterra’s small business budget template is easy to use and employs all of the components we defined above, like fixed costs, variable costs, revenue, and profit.

- Tracking progress against estimated revenue can also reveal potential issues within a full business plan.

- Create your budget using the numbers from historical profit and loss statements.

- Note also that minority-owned businesses can register as a minority business enterprise to receive additional support.

You should reference your budget often and make adjustments as circumstances change. We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Figure out your fixed costs

And as your business gets bigger, it’s a good idea to get guidance from a tax advisor. You’ll need a tax preparer or CPA to make a profit and loss (P&L) statement for you. This statement is just a way to look in the rearview mirror to see what happened in the last month, quarter or year. But since it can’t tell you what’s going to happen in the future, you’ll need to start with a business budget to help you look forward.

These costs may be called leasehold improvements or tenant improvements. For example, you may need walls or a bathroom or a special secure area in your office or building. Above all, once you have a clear sense of your profitability for the month, you can use it to make the right financial decisions for your small business moving forward. Before we jump into how to create a business budget, let’s quickly cover what a business budget is—and why it’s so important for your small business. But there’s one element that you want to stay on top of from the very beginning—and that’s your business budget. However, one of your other goals is to generate a 10% net profit margin for the year.

Do your due diligence by researching industry benchmarks for salaries, rent, and marketing costs. Ask your network what you can expect to pay for professional fees, benefits, and equipment. Set aside a portion of your budget for advisors—accountants, lawyers, that kind of thing. A few thousand dollars upfront could save you thousands more in legal fees and inefficiencies later on. In your spreadsheet, create a summary page with a row for each of the budget categories above. Then, next to each category, list the total amount you’ve budgeted.

What is the 50 20 30 budget rule?

The rule is to split your after-tax income into three categories of spending: 50% on needs, 30% on wants, and 20% on savings. 1. This intuitive and straightforward rule can help you draw up a reasonable budget that you can stick to over time in order to meet your financial goals.

When you’re creating a business budget, make sure you put aside extra cash and plan for contingencies. Notice how your business’s monthly income changes over time and try to look for seasonal patterns. Your business might experience a slump after the holidays, for example, or during the summer months. Understanding these seasonal changes will help you prepare for the leaner months and give you time to build a financial cushion.

As such, it is advisable for business owners to log all expenses and make sure that their records are accurate. Receipts can be kept either digitally or physically in the form of paper invoices and receipts. Tracking progress against estimated revenue can also reveal potential issues within a full business plan.

- Next, subtract your total expenses from your total revenue and you’ll have either a positive number, meaning your business turned a profit, or a negative number, which is a loss.

- By now you’ll have a great idea of how much your business has to spend each month, once all of your bills and payments are sorted.

- So if you find you need a loan for something, you have everything you need to go and apply for one right away.

- Microsoft Excel makes it easy to organize and chart your small business budget over time.

- Divvy is not too old in the market, but the features it offers are impressive.

- Once you’ve logged all income from different sources, estimate your fixed costs.

Aside from tax advantages, you set your business up for higher profit margins. Note also that minority-owned businesses can register as a minority business enterprise to receive additional support. If you want to be successful in business, then you need to know where every dollar goes.

How to Create a Budget for a Small Business in 10 Steps

While many of these expenses are necessary for your business, when you go through these costs, you may find extras that you can cut out. If business is slower during certain times of the year, consider trimming down variable expenses, such as marketing costs, to make more room in your budget. Variable costs might include raw materials, inventory, production costs, packaging, or shipping. Other variable costs can include sales commission, credit card fees, and travel.